Maximizing Revenue from a Blog on Commercial Property Insurance Quotes: Effective Strategies Using AdSense

Unlock the full potential of your blog on commercial property insurance quotes with our guide to maximizing revenue. Discover effective AdSense strategies that drive more clicks and increase your earnings.

Monetizing a blog focused on commercial property insurance quotes through AdSense involves a combination of attracting high-quality traffic and optimizing ad placements. In this guide, we’ll explore strategies to enhance your blog’s revenue, focusing on various types of insurance quotes and targeting specific USA cities: Omaha, Sacramento, Rochester, Albuquerque, and Richmond.

Understanding Your Audience and Keywords

To effectively monetize your blog, start by understanding your audience's needs. If your blog is about commercial property insurance quotes, potential readers are likely seeking information on various insurance types, including:

- General liability insurance quotes

- Professional liability insurance quotes

- Workers' compensation insurance quotes

- Business owner’s policy quotes

- Small business insurance quotes

- Commercial auto insurance quotes

- Cyber liability insurance quotes

- Business interruption insurance quotes

- Errors and omissions insurance quotes

- Product liability insurance quotes

- Directors and officers insurance quotes

- Health insurance for small businesses quotes

- Business liability insurance quotes

- Construction insurance quotes

- Franchise insurance quotes

- Retail business insurance quotes

- Restaurant insurance quotes

- Home-based business insurance quotes

- Agricultural business insurance quotes

- Nonprofit organization insurance quotes

- Technology business insurance quotes

- Real estate business insurance quotes

- Transportation business insurance quotes

- Manufacturing business insurance quotes

- Consulting business insurance quotes

- E-commerce business insurance quotes

- Event insurance quotes

2. Attracting High-Quality Traffic

1. Keyword Optimization:

Incorporate relevant keywords throughout your blog posts to ensure they rank well in search engine results. Use a mix of broad and specific terms like commercial property insurance quotes and cyber liability insurance quotes. Focus on the long-tail keywords that are likely to drive more targeted traffic, such as small business insurance quotes in Sacramento or commercial auto insurance quotes for restaurants in Richmond.

2. Local SEO:

Optimize your blog for local search by incorporating city-specific keywords. For example, create content tailored to Omaha business insurance needs or Albuquerque commercial property insurance quotes. This will help attract readers from those areas who are looking for insurance information relevant to their location.

3. Quality Content:

Write high-quality, informative content that addresses the needs and concerns of your target audience. Include comprehensive guides, comparison charts, and case studies related to different types of insurance. For instance, a blog post on errors and omissions insurance quotes could outline what it covers, why it's important, and how to get the best rates.

4. SEO Best Practices:

Utilize SEO best practices to improve your search rankings. This includes optimizing your meta tags, headers, and image alt texts. Ensure your content is mobile-friendly and loads quickly, as these factors can affect your ranking and user experience.

5. Social Media Promotion:

Promote your blog on social media platforms to drive additional traffic. Share your articles on LinkedIn, Facebook, Twitter, and industry-specific forums. Engage with your audience by answering questions and participating in discussions related to business liability insurance quotes or construction insurance quotes.

3. Optimizing AdSense for Better Revenue

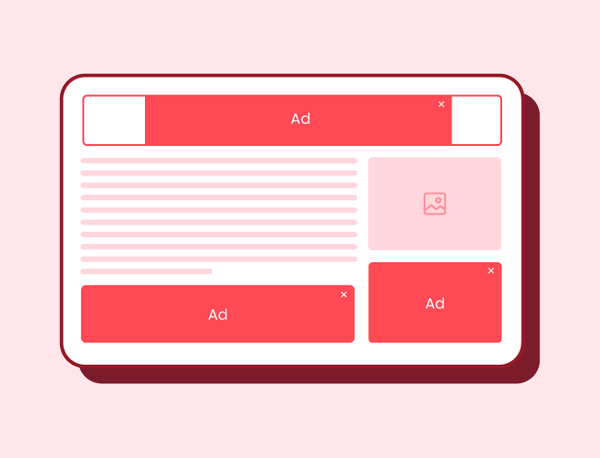

1. Ad Placement:

Strategic ad placement is crucial for maximizing AdSense revenue. Place ads in high-visibility areas of your blog, such as above the fold, within the content, and at the end of articles. Experiment with different ad formats and placements to find what works best for your audience.

2. Ad Format:

Choose ad formats that blend well with your blog’s design but still stand out. Responsive ads that adjust to various screen sizes can provide a better user experience and increase click-through rates. Consider using text and display ads to diversify your ad inventory.

3. Targeted Ads:

Use AdSense’s targeting features to display relevant ads based on your content and audience interests. This ensures that ads related to commercial property insurance quotes or health insurance for small businesses quotes are shown to readers who are most likely to be interested in them.

4. A/B Testing:

Conduct A/B testing to determine which ad formats and placements generate the most revenue. Test different variations of ad styles, sizes, and locations to optimize your setup for higher earnings. Regularly review performance metrics to adjust your strategy as needed.

5. Ad Balance:

Maintain a balance between ad density and content to avoid overwhelming your readers. Too many ads can negatively impact user experience and lead to higher bounce rates. Aim for a clean, professional look that encourages visitors to stay longer and explore more of your content.

4. Leveraging Specific City-Based Strategies

1. Omaha:

Focus on commercial property insurance quotes in Omaha by creating content specific to local regulations and market conditions. Highlight businesses and industries prevalent in Omaha and offer tailored insurance solutions.

2. Sacramento:

For Sacramento, provide insights into general liability insurance quotes for local businesses. Discuss unique risks faced by Sacramento-based companies and how to address them through insurance.

3. Rochester:

Create articles about business interruption insurance quotes and how they can help Rochester businesses recover from unforeseen disruptions. Include case studies of local businesses that have benefited from this type of insurance.

4. Albuquerque:

In Albuquerque, target workers' compensation insurance quotes by addressing local labor laws and employee protection regulations. Offer advice on how businesses can ensure compliance and protect their workforce.

5. Richmond:

For Richmond, emphasize commercial auto insurance quotes and how they apply to businesses in the region. Discuss local driving conditions and risks to provide valuable insights to Richmond business owners.

5. Enhancing User Experience

1. Improve Navigation:

Ensure your blog is easy to navigate with a clear menu and search functionality. This helps visitors quickly find information on different types of insurance quotes and encourages them to explore more pages.

2. Use Engaging Visuals:

Incorporate visuals such as infographics, charts, and videos to make complex information more digestible. For example, create a comparison chart of business owner’s policy quotes or an infographic explaining errors and omissions insurance.

3. Regular Updates:

Keep your content up-to-date with the latest industry trends and insurance options. Regularly updating your blog with fresh, relevant content can improve search engine rankings and keep readers engaged.

4. Encourage Interaction:

Engage with your audience through comments, surveys, and feedback forms. This interaction can provide valuable insights into their needs and preferences, helping you tailor your content and ad placements more effectively.

Maximizing Your Business Protection: A Comprehensive Guide to Commercial Property Insurance Quotes

In today’s rapidly evolving business landscape, securing the right insurance coverage is paramount for safeguarding your commercial property and ensuring long-term stability. Whether you’re operating in Omaha, Sacramento, Rochester, Albuquerque, or Richmond, understanding and obtaining the appropriate commercial property insurance quotes can make a significant difference. This article will guide you through various types of insurance quotes that can help shield your business from unexpected events, enhance your protection strategy, and optimize your insurance spend.

Understanding Commercial Property Insurance Quotes

Commercial property insurance is designed to cover damages to your business property due to unforeseen events such as fire, theft, or natural disasters. Obtaining accurate commercial property insurance quotes is essential for ensuring you have the right coverage tailored to your specific needs.

Key Factors Influencing Your Insurance Quotes

-

Location: Insurance premiums can vary significantly based on your location. For instance, businesses in urban areas like Sacramento or Albuquerque might face different risks compared to those in smaller cities like Rochester.

-

Property Type and Value: The type of property and its value play a crucial role in determining your insurance premium. A high-value commercial building will generally incur higher insurance costs.

-

Business Operations: The nature of your business operations also affects insurance quotes. For example, a retail business in Richmond will have different risks compared to a technology business in Omaha.

Essential Types of Business Insurance Quotes

1. General Liability Insurance Quotes

General liability insurance covers your business against claims of bodily injury, property damage, and personal injury. It’s fundamental for any business, regardless of size or industry. Securing accurate general liability insurance quotes helps you understand the cost associated with this essential coverage.

2. Professional Liability Insurance Quotes

Professional liability insurance, also known as errors and omissions insurance, protects businesses that provide professional services from claims of negligence or mistakes. For businesses in consulting or technology sectors, professional liability insurance quotes are crucial.

3. Workers' Compensation Insurance Quotes

Workers' compensation insurance provides coverage for employees who are injured on the job. This insurance is mandatory in many states. Obtaining workers' compensation insurance quotes helps businesses manage the cost of employee-related injuries and complies with legal requirements.

4. Business Owner’s Policy Quotes

A Business Owner’s Policy (BOP) bundles several types of coverage into one policy, typically including general liability insurance and commercial property insurance. This can be a cost-effective way to obtain comprehensive protection. Explore various business owner’s policy quotes to find the best fit for your business needs.

5. Small Business Insurance Quotes

Small businesses often require tailored insurance solutions to address their unique risks. Obtaining small business insurance quotes ensures that you have appropriate coverage for property, liability, and employee-related risks.

6. Commercial Auto Insurance Quotes

If your business uses vehicles, commercial auto insurance is necessary. This coverage protects your business from financial loss due to vehicle-related incidents. Get commercial auto insurance quotes to determine the best policy for your fleet.

7. Cyber Liability Insurance Quotes

In the digital age, protecting your business from cyber threats is essential. Cyber liability insurance covers losses related to data breaches and cyberattacks. Obtain cyber liability insurance quotes to safeguard your business’s digital assets.

8. Business Interruption Insurance Quotes

Business interruption insurance provides coverage for lost income due to unforeseen events that disrupt your operations. This is crucial for businesses in high-risk areas. Explore business interruption insurance quotes to ensure you can maintain financial stability during emergencies.

9. Errors and Omissions Insurance Quotes

Errors and omissions insurance is another term for professional liability insurance. It protects your business against claims of inadequate work or mistakes. Securing accurate errors and omissions insurance quotes is vital for service-based businesses.

10. Product Liability Insurance Quotes

For businesses that manufacture or sell products, product liability insurance covers claims related to product defects and safety issues. Get product liability insurance quotes to ensure your products are adequately protected.

11. Directors and Officers Insurance Quotes

Directors and officers insurance provides coverage for the management team of a company against claims of mismanagement. This insurance is crucial for businesses with a board of directors. Obtain directors and officers insurance quotes to protect your leadership team.

12. Health Insurance for Small Businesses Quotes

Providing health insurance for small businesses is an attractive benefit for employees and can enhance recruitment and retention. Explore various health insurance for small businesses quotes to find plans that offer comprehensive coverage for your team.

13. Construction Insurance Quotes

Construction insurance covers various risks associated with construction projects, including property damage and liability. For businesses in the construction industry, securing construction insurance quotes is essential for protecting your projects.

14. Franchise Insurance Quotes

Franchises have unique insurance needs that differ from independent businesses. Franchise insurance covers various aspects of operating a franchise, including property and liability. Obtain franchise insurance quotes to address these specific needs.

15. Retail Business Insurance Quotes

Retail business insurance covers the specific risks associated with operating a retail store, including property damage and customer injuries. Explore retail business insurance quotes to tailor coverage to your retail operations.

16. Restaurant Insurance Quotes

Restaurants face unique risks such as foodborne illnesses and kitchen fires. Restaurant insurance provides coverage for these risks. Get restaurant insurance quotes to ensure your establishment is well-protected.

17. Home-Based Business Insurance Quotes

Home-based business insurance covers the specific risks associated with running a business from your home. This type of insurance can be more affordable and tailored to home-based operations. Explore home-based business insurance quotes for appropriate coverage.

18. Agricultural Business Insurance Quotes

Businesses in the agriculture sector face risks related to crops, livestock, and equipment. Agricultural business insurance provides specialized coverage for these risks. Obtain agricultural business insurance quotes to protect your farming operations.

19. Nonprofit Organization Insurance Quotes

Nonprofit organization insurance is designed to cover the unique risks faced by nonprofits, including liability and property damage. Explore nonprofit organization insurance quotes to ensure your mission is protected.

20. Technology Business Insurance Quotes

Technology business insurance covers risks specific to tech companies, such as cyber threats and intellectual property issues. Get technology business insurance quotes to safeguard your innovative ventures.

21. Real Estate Business Insurance Quotes

Real estate business insurance addresses risks associated with property management and real estate transactions. Obtain real estate business insurance quotes to ensure comprehensive protection for your real estate activities.

22. Transportation Business Insurance Quotes

Transportation business insurance covers risks related to the logistics and movement of goods. For businesses involved in transportation, securing transportation business insurance quotes is crucial for managing these risks.

23. Manufacturing Business Insurance Quotes

Manufacturing business insurance covers risks related to production processes, equipment, and employee safety. Obtain manufacturing business insurance quotes to protect your manufacturing operations effectively.

24. Consulting Business Insurance Quotes

Consulting business insurance is tailored to the needs of consultants, providing coverage for professional errors and client-related claims. Explore consulting business insurance quotes to find the right protection for your consulting services.

25. E-Commerce Business Insurance Quotes

E-commerce business insurance covers risks associated with online sales, including cyber threats and product liability. For online retailers, obtaining e-commerce business insurance quotes ensures your virtual storefront is secure.

26. Event Insurance Quotes

Event insurance covers various risks associated with hosting events, such as cancellations and liability issues. For businesses organizing events, securing event insurance quotes provides peace of mind and financial protection.

Selecting Profitable Adsense Niches in Commercial Property Insurance

In the competitive world of digital advertising, choosing the right Adsense niches within the commercial property insurance sector can significantly impact your revenue potential. This article will guide you through the key factors to consider when selecting niches and offer strategies to identify and target profitable sub-niches, particularly related to insurance quotes. We’ll also highlight key types of insurance, provide actionable tips, and explore targeted cities like Omaha, Sacramento, Rochester, Albuquerque, and Richmond.

Understanding Key Factors for Selecting Adsense Niches

-

Market Demand and Competition

- High Demand: Choose niches with strong demand for commercial property insurance. Research search volume using tools like Google Keyword Planner to determine the popularity of specific insurance types.

- Competition Analysis: Evaluate competition using SEO tools. Niches with high competition may be harder to rank for but often come with higher potential rewards. Balance between high-demand and manageable competition for the best results.

-

Profitability of Keywords

- Cost-Per-Click (CPC): Analyze the CPC for keywords related to various types of insurance quotes. Higher CPCs often indicate higher profitability. Keywords like "commercial property insurance quotes" or "business liability insurance quotes" typically have significant revenue potential.

- Revenue Per Click: Aim for niches where the potential revenue per click aligns with your goals. Insurance niches generally offer higher CPC rates compared to other sectors.

-

Relevance to Your Audience

- Target Audience: Consider the type of businesses or individuals looking for insurance quotes. For instance, small business insurance quotes may attract a different audience compared to cyber liability insurance quotes.

- Geographic Relevance: Tailor content to specific cities such as Omaha, Sacramento, Rochester, Albuquerque, and Richmond to capture local search traffic and increase relevancy.

-

Content Quality and Authority

- Informative Content: Create high-quality, informative content about various insurance quotes. Include details on general liability insurance quotes, workers' compensation insurance quotes, and more to build authority and attract search engine traffic.

- Expert Opinions: Featuring insights from industry experts can enhance credibility and attract more visitors seeking detailed information.

Identifying and Targeting Profitable Sub-Niches

-

Sub-Niche Research

- Insurance Types: Dive into specific insurance types like errors and omissions insurance quotes or product liability insurance quotes. These sub-niches often have less competition but still significant search interest.

- Local Market Needs: Research the unique needs of businesses in targeted cities. For example, construction insurance quotes might be more relevant in Sacramento due to the city’s growing infrastructure projects.

-

Keyword Strategy

- Long-Tail Keywords: Use long-tail keywords to capture more specific search queries. For instance, "affordable commercial auto insurance quotes in Omaha" can attract users looking for targeted solutions.

- Local Keywords: Incorporate city-specific keywords to attract local businesses. Phrases like "restaurant insurance quotes in Richmond" can help you reach the right audience.

-

Competitor Analysis

- Evaluate Competitors: Analyze what competitors are targeting and find gaps in their strategies. For example, if competitors focus heavily on health insurance for small businesses quotes, you might find opportunities in less covered areas like cyber liability insurance quotes.

- Content Differentiation: Create content that offers something different from competitors. If many are focusing on general liability insurance quotes, consider providing detailed comparisons or case studies.

-

SEO and User Experience

- On-Page SEO: Optimize your content with relevant keywords and ensure that your website provides a good user experience. Use keywords like "business interruption insurance quotes" and "commercial property insurance quotes" in headings, meta descriptions, and throughout the content.

- Mobile Optimization: Ensure your site is mobile-friendly as many users search for insurance quotes on their phones. A responsive design can improve user experience and SEO.

Examples of Profitable Sub-Niches and Targeted Strategies

-

Small Business Insurance Quotes

- Target Cities: Omaha, Richmond

- Strategy: Create content that addresses the specific insurance needs of small businesses in these cities, including localized regulations and coverage options.

-

Cyber Liability Insurance Quotes

- Target Cities: Sacramento, Albuquerque

- Strategy: Focus on industries vulnerable to cyber threats and highlight local examples or case studies.

-

Restaurant Insurance Quotes

- Target Cities: Sacramento, Richmond

- Strategy: Develop content that covers specific risks and insurance solutions for restaurant owners in these areas.

-

Construction Insurance Quotes

- Target Cities: Sacramento, Rochester

- Strategy: Address the insurance needs of construction businesses, including coverage for equipment and worker safety in these cities.

-

E-Commerce Business Insurance Quotes

- Target Cities: Albuquerque, Omaha

- Strategy: Cater to the growing e-commerce sector by offering insights into insurance needs specific to online businesses.

Analyzing the Performance of AdSense Ads Using Google Analytics: A Guide for Commercial Property Insurance Websites

When running a website that offers commercial property insurance quotes, such as those for general liability insurance, professional liability insurance, workers' compensation insurance, and more, optimizing AdSense ad performance is crucial for maximizing revenue. Leveraging Google Analytics effectively can help you achieve this by providing insights into user behavior and ad performance. This guide will walk you through how to use Google Analytics to analyze and enhance your AdSense revenue, with a focus on various types of insurance quotes and targeted cities like Omaha, Sacramento, Rochester, Albuquerque, and Richmond.

Understanding Google Analytics and AdSense Integration

Google Analytics is a powerful tool for tracking and analyzing your website traffic. When integrated with AdSense, it provides valuable data on how your ads are performing. To begin, ensure that your AdSense account is linked with Google Analytics. This allows you to access detailed reports on ad performance, such as click-through rates (CTR), cost per click (CPC), and overall revenue.

Key Metrics to Monitor

To maximize your ad revenue, focus on the following metrics within Google Analytics:

-

Ad Performance Metrics:

- Revenue Per Click (RPC): This metric indicates how much revenue you're earning per click on your ads. Higher RPC means better performance.

- Click-Through Rate (CTR): CTR measures the percentage of visitors who click on your ads. A higher CTR typically indicates more engaging ads.

- Cost Per Click (CPC): CPC tells you how much you earn per click. Understanding this helps in evaluating the profitability of your ads.

-

User Behavior Metrics:

- Session Duration: Longer sessions may suggest that users find your content engaging. This can lead to more ad clicks.

- Pages Per Session: More pages viewed can mean more ad impressions. Ensure your site has relevant content that encourages users to explore.

- Bounce Rate: A high bounce rate can indicate that visitors are not finding what they’re looking for. Lowering the bounce rate can improve ad performance by keeping users on your site longer.

-

Traffic Sources:

- Referral Traffic: Analyze which sources (search engines, social media, etc.) are driving the most traffic to your site. This can help you understand where your highest-performing visitors come from.

- Organic vs. Paid Traffic: Compare the performance of ads on pages that receive organic traffic versus those with paid traffic to gauge which is more profitable.

-

Audience Demographics:

- Location: Identify which cities (like Omaha, Sacramento, Rochester, Albuquerque, Richmond) generate the most revenue. Tailor your ad campaigns to target these regions more effectively.

- Device and Browser: Understand whether your audience is primarily using mobile devices or desktops. Optimize your ad placements accordingly.

Optimizing AdSense Performance

-

Ad Placement:

- Above the Fold: Place ads in prominent positions where users can see them without scrolling. This can increase visibility and click-through rates.

- In-Content Ads: Integrate ads within your content, particularly in high-engagement areas such as between paragraphs or at the end of articles. This can improve ad performance for users seeking business insurance quotes or commercial property insurance quotes.

-

Ad Formats:

- Experiment with different ad formats, such as text ads, display ads, and responsive ads. Some formats may perform better depending on the content and layout of your site.

-

Content Relevance:

- Ensure that your site’s content is relevant to the ads displayed. For example, if your site offers health insurance for small businesses quotes, ads related to healthcare or small business insurance are more likely to be effective.

-

A/B Testing:

- Conduct A/B testing on different ad placements and formats to determine which combinations yield the best results. This helps in fine-tuning your ad strategy.

-

Geo-Targeting:

- Use Google Analytics to identify which geographic regions are most lucrative. If certain cities like Sacramento or Albuquerque show higher ad revenue, focus on targeted marketing strategies for those areas.

Case Study: Optimizing AdSense for Commercial Property Insurance

Consider a website specializing in commercial property insurance quotes with a range of insurance products including general liability insurance quotes, workers' compensation insurance quotes, and cyber liability insurance quotes. By analyzing Google Analytics data, the site discovers that ads placed on pages with small business insurance quotes generate significantly higher CTR and RPC compared to other pages.

To capitalize on this, the site owner decides to:

- Increase the number of small business insurance quotes pages with premium ad placements.

- Target ads to users in high-performing cities like Richmond and Omaha.

- Experiment with different ad formats on these pages to find the most effective combination.

Additionally, they use audience demographics data to tailor content and ads specifically for users interested in commercial property insurance quotes and product liability insurance quotes. This focused approach helps in boosting overall ad performance and revenue.

SEO Best Practices for Commercial Property Insurance Quotes Websites

If you manage a website that provides commercial property insurance quotes and other related services, optimizing your site for search engines is crucial for attracting more visitors and increasing AdSense revenue. Here’s a comprehensive guide to help you enhance your site’s visibility and performance.

1. Keyword Research and Optimization

Effective SEO starts with identifying the right keywords. For a website focused on commercial property insurance quotes, consider using a mix of primary and long-tail keywords. Here’s how you can strategically incorporate them:

- Commercial Insurance Quotes: Ensure this primary keyword is prominently featured in titles, headers, and throughout your content.

- General Liability Insurance Quotes, Professional Liability Insurance Quotes, and other specific insurance types should be included in both content and meta descriptions.

- For localized SEO, incorporate target cities such as Omaha, Sacramento, Rochester, Albuquerque, and Richmond in your content. For instance, "Find the best commercial property insurance quotes in Omaha."

Example: "Looking for general liability insurance quotes in Sacramento? Our platform offers tailored solutions for your business needs."

2. High-Quality Content Creation

Create engaging, informative, and original content that addresses the needs of your target audience. Here are some content ideas:

- Comprehensive Guides: Develop detailed articles about different types of insurance, such as business owner’s policy quotes or workers' compensation insurance quotes.

- Comparison Articles: Write comparisons of various insurance policies to help users understand their options.

- Local Insights: Offer insights into insurance needs and regulations specific to cities like Richmond or Albuquerque.

Example: "Understand the nuances of cyber liability insurance quotes and how they impact businesses in Rochester."

3. On-Page SEO Techniques

Optimize your content with these on-page SEO strategies:

- Title Tags and Meta Descriptions: Use clear, keyword-rich titles and descriptions. For example, "Get Accurate business liability insurance quotes in Albuquerque."

- Headers: Utilize H1, H2, and H3 tags to structure your content and include relevant keywords.

- Internal Linking: Link to related articles within your site to enhance user experience and improve SEO.

Example: "H2: Why commercial property insurance quotes Are Essential for Small Businesses in Sacramento."

4. Local SEO Optimization

Since you’re targeting specific cities, local SEO is vital:

- Google My Business: Set up and optimize your Google My Business profile for each city you target.

- Local Keywords: Incorporate city names with insurance-related keywords throughout your content.

- Local Listings: Ensure your business is listed in local directories and review sites.

Example: "Explore retail business insurance quotes tailored for Omaha businesses."

5. Mobile Optimization

Ensure your website is mobile-friendly. Many users will access your site via smartphones, so:

- Responsive Design: Use a responsive design that adapts to various screen sizes.

- Fast Loading Times: Optimize images and reduce code bloat to improve loading times.

6. User Experience and Engagement

A well-designed user experience encourages visitors to stay longer and interact with your content:

- Clear Navigation: Make it easy for users to find information and get quotes.

- Interactive Tools: Implement quote calculators or comparison tools to engage users.

- Call-to-Actions (CTAs): Use compelling CTAs to encourage users to request quotes or contact you.

Example: "Use our easy-to-use tool to get personalized construction insurance quotes for your project in Albuquerque."

7. Backlink Strategy

Build high-quality backlinks to increase your site’s authority:

- Guest Posts: Write guest articles for industry blogs and include links back to your site.

- Industry Directories: Get listed in relevant industry directories.

- Press Releases: Use press releases to share news and gain backlinks.

Example: "Check out our recent feature on e-commerce business insurance quotes in a leading industry publication."

8. Content Freshness and Updates

Regularly update your content to keep it relevant:

- Revise Old Articles: Update existing articles with new information and current trends.

- Add New Content: Continuously publish new content related to various types of insurance.

Example: "Stay informed with the latest updates on errors and omissions insurance quotes for Richmond businesses."

9. Monitor and Analyze Performance

Use tools like Google Analytics and Google Search Console to track your site’s performance:

- Traffic Sources: Analyze where your traffic is coming from and adjust your strategies accordingly.

- Keyword Rankings: Monitor your keyword rankings and make changes to improve them.

- User Behavior: Understand how users interact with your site and make necessary improvements.

Example: "Track the performance of your business interruption insurance quotes page and optimize based on user engagement data."

What's Your Reaction?

.jpg)