Europe Textile Recycling Market Overview: Size, Share, Trends, and Key Growth Drivers

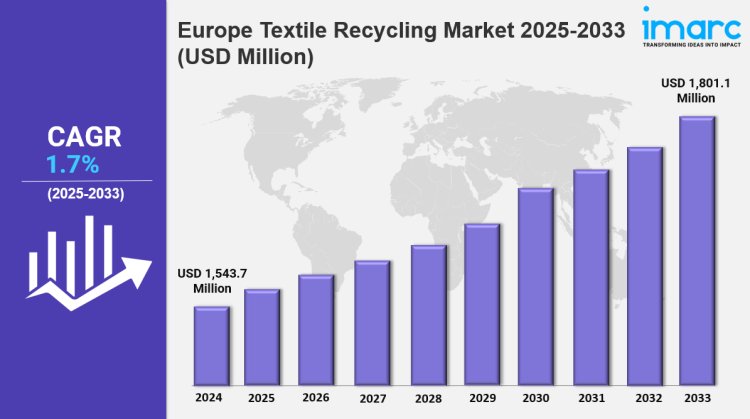

The Europe textile recycling market size was valued at USD 1,543.70 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,801.10 Million by 2033, exhibiting a CAGR of 1.7% from 2025-2033.

Market Overview 2025-2033

The Europe textile recycling market size reached USD 1,543.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,801.1 Million by 2033, exhibiting a growth rate (CAGR) of 1.7% during 2025-2033. The market is growing due to rising sustainability awareness, increasing government regulations, and demand for circular fashion. Technological advancements, eco-friendly initiatives, and expanding recycling infrastructure are key factors driving industry expansion.

Key Market Highlights:

✔️ Strong market growth driven by increasing sustainability awareness and circular economy initiatives

✔️ Rising demand for recycled fibers in fashion, home textiles, and industrial applications

✔️ Expanding government regulations promoting textile waste reduction and eco-friendly production

Request for a sample copy of the report: https://www.imarcgroup.com/europe-textile-recycling-market/requestsample

Europe Textile Recycling Market Trends and Drivers:

The European textile recycling market is undergoing rapid transformation, driven by robust circular economy policies. Under the EU’s Circular Economy Action Plan, member states are required to cut textile waste significantly, with a goal of recycling 60% of post-consumer textiles by 2030. This initiative spurred a surge in investments throughout 2024, especially in mechanical and chemical recycling technologies, with Germany, France, and the Netherlands leading the charge.

Innovative startups like Infinitely Recycled Fibers are advancing enzymatic recycling methods to process blended fabrics more efficiently. Simultaneously, major fast-fashion brands such as H&M and Zara are collaborating with recyclers to incorporate more recycled polyester and cotton into their collections. Municipalities across Europe have stepped up as well, adding over 12,000 textile drop-off points in 2024 to strengthen collection systems.

Despite this momentum, challenges persist. Standardizing sorting technologies remains a hurdle, and the prevalence of low-quality synthetic blends makes recycling more complex. Regulatory pressure is mounting, forcing brands to redesign supply chains and adopt closed-loop production models.

A key regulatory shift is the updated EU Waste Framework Directive, effective from 2024. It mandates that apparel producers cover 80% of textile waste management costs under Extended Producer Responsibility (EPR) schemes. Non-compliant companies face fines of up to 4% of their annual revenue, pushing many brands to form alliances with recyclers like Lenzing and Re:newcell.

France and Italy have also banned the landfill disposal of unsold clothing, requiring retailers to either recycle or donate excess stock. This has increased demand for industrial-scale recycling facilities. Notably, the polyester-to-polyester recycling segment is projected to grow by 22% annually through 2030. However, smaller brands are struggling with the cost of compliance, widening the gap between sustainability frontrunners and those falling behind.

Consumer behavior is also evolving. In 2024, 68% of European consumers express willingness to pay more for products made from recycled textiles. Resale platforms such as Vinted and Depop are launching B2B resale programs, while luxury brands like Gucci now offer repair and refurbishment services. This shift has led to a 35% year-on-year increase in second-hand clothing sales. Retailers are responding by launching take-back schemes and adopting blockchain tools to validate recycled content, with brands like Patagonia leading the way. Still, greenwashing concerns persist—42% of consumers remain skeptical of corporate sustainability claims.

Overall, the European textile recycling industry is being reshaped by stricter laws, technological innovation, and shifting consumer priorities. A key trend in 2024 is “fibre-to-fibre” recycling, which aims to replace virgin materials. Companies like Worn Again Technologies are piloting chemical recycling plants with a capacity of 20,000 tons of mixed textiles annually, backed by €500 million in EU funding.

Cross-border cooperation is growing too. Nordic nations are sharing best practices for textile collection logistics, while Southern European countries are embracing upcycling and artisanal solutions to minimize waste. Market consolidation is also underway, with large players like Veolia acquiring smaller recyclers to boost their capabilities. However, issues like fluctuating raw material costs and poor infrastructure in parts of Eastern Europe—where landfill rates remain high—continue to pose challenges. Nevertheless, driven by policy, innovation, and a cultural shift toward circularity, the Europe textile recycling market is poised for strong growth.

Europe Textile Recycling Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

-

Cotton Recycling

-

Wool Recycling

-

Polyester & Polyester Fibre Recycling

-

Nylon & Nylon Fibre Recycling

-

Others

Breakup by Textile Waste:

-

Pre-consumer Textile

-

Post-consumer Textile

Breakup by Distribution Channel:

-

Online Channel

-

Retail & Departmental Stores

Breakup by End Use:

-

Apparel

-

Industrial

-

Home Furnishings

-

Non-woven

-

Others

Breakup by Country:

-

Germany

-

France

-

United Kingdom

-

Italy

-

Spain

-

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

.jpg)